While it may not be clear sailing for the economy in 2016, a number of factors will keep the economy growing and avoid a recession, according to Cal State Fullerton economists Anil Puri and Mira Farka. On Thursday (April 28), they presented the Midyear Economic Forecast, “Winter Blues or Turning Point.”

The recovery has been slow and to some extent, painful. And yet, the fact that it has been so sluggish may actually extend its life, say the two economists, who gave a measured positive forecast for the rest of 2016.

“The recovery is now almost 7 years old,” said Puri, dean of Mihaylo College of Business and Economics. “Are we ready for a downturn?

“Just because it’s been long” — he noted that it is the fourth longest recovery in U.S. history — “doesn’t mean that it’s nearing its end.

“We believe we’re not at the end of recovery,” Puri told the audience of business and community leaders.

“Forget the idea of a ‘splendid’ recovery. This recovery has labored quite hard to just rise to the status of the mediocre,” said Farka, associate professor of economics, who noted many ‘positives’ were still not where they should be by now.

“And in a weird and perverse way, the fact that this has been a slow, subpar and anemic recovery will keep it going for awhile longer, because there is still quite a bit of room to grow,” she said.

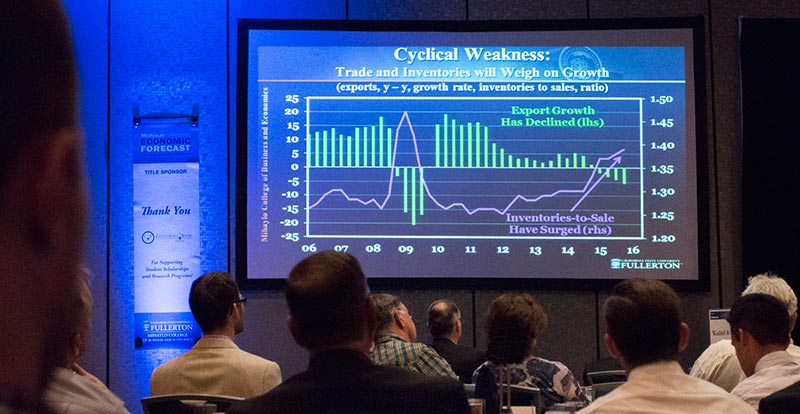

Structural issues (deleveraging and demographics) and cyclical problems (inventory, trade, strong dollar and low oil prices) will restrain economic growth over the next few quarters. The production side, particularly energy and manufacturing sectors, will also weigh on the outlook, they noted.

“Energy and manufacturing are still in a world of hurt,” said Farka. Both economists see these sectors growing at a slow pace through 2016 and 2017.

Helping the economy along is the “resiliency of the U.S. consumer,” Puri explained, noting that last year consumer spending grew by 3.1 percent — the highest pace since 2005 — but is expected to grow at a more moderate pace over the next two years.

A true bright spot they identified in the national economy: jobs. While the country lost 8.8 million jobs during the recent recession, it has regained 14 million jobs since then. And while some believe that the growth has been in part-time work, the economists disagree, since full-time employment has picked up dramatically, with two million more jobs now than compared to 2007 levels.

“Employment is better than it was before,” Puri said. “No matter which way you look at the labor market, it’s better.”

Will wages pick up? Puri and Farka believe so, but again at a moderate pace, due largely to demographic forces: replacement of high-wage boomers with low-wage millennials will continue for some time to come, somewhat moderating the pace of wage growth.

On the gloomy side of the discussion: business investments and expansion, and global growth. The timing and pace of rate hikes in the U.S. could be a major risk, the scholars noted. Other risks would include ballooning debt levels in China and slow growth — in some cases outright recession — in emerging market economies.

Orange County and Southern California

More locally, Puri and Farka believe that California’s economy has picked up robustly and has outperformed the national economy in many dimensions. The same is true for the Southern California region of Orange, Los Angeles, Riverside, San Bernardino, Ventura and Imperial counties.

Puri called Orange County’s job growth “very impressive,” noting that OC’s employment increased by 3.2 percent in 2015 and is expected to grow by 3.1 percent in 2016. The same applies to other Southland counties.

The construction sector had the most spectacular growth with an increase of 8,400 jobs in 2015 — a 10.2 percent increase.

The full midyear economic forecast report can be found online at www.business.fullerton.edu/midyear.